Consumer behaviour advisory company Circana unveiled its latest food industry insights, detailing changing consumer spending patterns and sales of fast-moving consumer goods (FMCG).

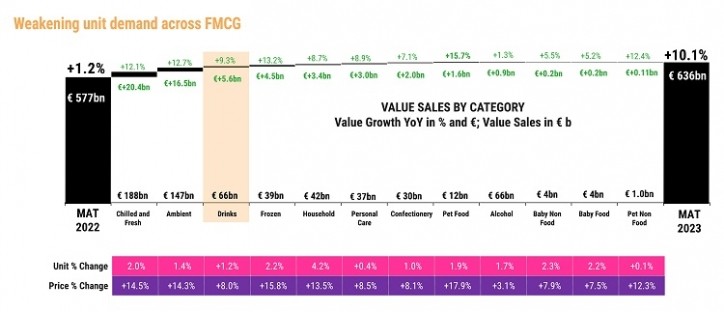

In its latest FMCG Demand Signals report, Circana data reveals that FMCG value sales continue to be driven almost entirely by inflation, which has grown by a further 10.1% year-on-year (YoY) to reach €636 billion. There is weakening unit demand across FMCG that is not expected to recover before the second half of 2024 as European consumers continue to buy less, with a 1.3% decline in unit sales over the past year.

“Inflation-fatigued consumers are favouring discounted and deal-driven shopping,” Ananda Roy, Global SVP, Strategic Growth Insights, Circana, told FoodNavigator. “Despite these challenges, prospects for growth and resilience lie in innovation, sustainability, and strategic pricing strategies to withstand future shocks,” Roy added.

Today’s food industry is facing “a new era in pricing”, Roy said. In this era of shifting consumer loyalties, manufacturers and retailers must reevaluate their pricing strategies to enhance demand, safeguard volume, and achieve unit growth. Food and beverage brands need to adopt a fresh approach to pricing, avoiding changes that erode margins without generating considerable volume increases. “The looming threat of a price war underscores the importance for brands to avoid a race to the bottom,” Roy detailed.

Evolving consumer purchasing habits

The report revealed that at this stage in the cost-of-living crisis, shoppers have adopted a range of behaviours to moderate the impact of rising prices. Shopping around, buying smaller packs of food, buying more from discounters and being smart about deals are popular ways today’s consumers are shopping.

Consumers are also highly price-focused when trying products. Therefore, if a product is not on sale or available at an attractive price, they will buy another brand, switch to a private-label option or move to a different retailer altogether.

There is also evidence that categories, products, and even out-of-home consumption once considered ‘everyday’ are now seen as discretionary by shoppers. “This does not mean they are no longer bought at all,” Roy said. Instead, more often, a product becoming discretionary suggests consumers are buying less of it, making what they have in their cupboards last longer or deferring their purchase.

“All of these coping behaviours—buying more from discounters, switching to private label brands and buying only essential items—will only go so far, though,” Roy said. Continued unit decline not only sees consumers shopping differently, but they also have to make difficult choices about what they can and can’t afford every time they shop. “Sometimes, the only affordable option open to them is to consume less, particularly since inflation is still focused on everyday food items,” Roy added.

Challenging consumer trends set to continue

Projections indicate that the pressures consumers face in making purchasing decisions will continue for the foreseeable future. “As global turmoil and uncertainty continue, many of the challenging consumer trends and behaviours we have seen over the last two years are set to continue for another year,” Roy shared.

Inflation has eased considerably in recent months. However, this would typically be expected to lead to a recovery in demand. “That unit sales have continued to drop shows how financially distressed consumers are and how fundamentally the cost-of-living crisis has changed their shopping habits,” added Roy.

Several factors explain why demand has remained unexpectedly weak, the report found. While business confidence and consumer sentiment have improved in the past six months, services inflation has begun. “Sky-high insurance costs, rents and mortgage interest rates are squeezing incomes in nominal terms,” Roy shared.

Recent news about food prices easing also needs to be put into context, Roy said. While FMCG price inflation is decreasing, prices remain much higher than in January 2021. As flagged in Circana’s previous Demand Signals report, ‘disinflation’ drives category pricing rather than deflation. “The net effect is that European shoppers continue to feel much worse off than they did two years ago,” Roy said.

Losing market share and gaining it back again

Food and beverage brands are missing market profits because private labels continue gaining ground, the report states, which follows the rise of supermarket private label brands and fewer new product launches. Circana’s last Demand Signals report 2023 flagged a ‘tipping point’ for private labels and indicated that European consumers increasingly perceive it as the quality choice. Six months on, the march of private labels continues. “What’s more, private labels are becoming increasingly premium,” added Roy.

Now accounting for 39% of grocery sales in the European Union (EU), the private label segment is worth €246 billion to retailers, having grown its value share by a further 2.2 percentage points in the last year, to June 2023. Two years ago, that share stood at 35%.

However, private-label expansion is not expected to continue. “It’s important to note that there will be a limit to private label growth,” Roy shared. In today’s European retail environment, retailers, like brands, are the biggest drivers of value, innovation and footfall. Retailers want private labels to compete vigorously with brands but don’t want brands to fail.

“Private labels must be regarded as serious competition, and brands must identify sources of growth and opportunity, particularly in the areas of innovation, sustainability and pricing, and boost their resilience to future shocks,” said Roy.

Now is a tough environment to do so, however. “Creating new demand is far from easy right now, but our analysis shows it can be done,” Roy shared. Intuitive, well-targeted innovation sits at the heart of a brand success story and pushing hard on new product development (NPD) gives shoppers fresh reasons to connect with a food and beverage category.

Looking ahead, the focus, the report asserts, is on inspiring shoppers and positioning products as versatile ingredients that can be used to create exciting meals.

“Over the next 12 months, the winning brands will invest in bold, agenda-setting NPD that responds to new consumer behaviours and consumption moments, not those who tinker around the edges of their portfolios,” Roy added.